The following are questions Jemma Financial is often asked with regard to investing in retirement and health savings accounts.

The following are questions Jemma Financial is often asked with regard to investing in retirement and health savings accounts.

Yes. Having a workplace plan such as a 401(k) or 403(b) does not affect your eligibility to contribute to a Traditional or Roth IRA, in general. There are important eligibility considerations regarding income limits and deductibility. For example, when investing in a Traditional IRA, anyone with earned income can contribute but when investing in a Roth IRA, your income must be below certain thresholds to fully or partially contribute.

No. You can set up automatic, recurring transfers from your checking or savings account into an IRA. When you purchase shares of a mutual fund or an exchange-traded fund (ETF) to fund the IRA on a regular basis, you may remove the chance of making short-term, emotionally fueled decisions based on current market performance.

If you have a 401(k) or 403(b) retirement plan, then you are already using this strategy called “dollar cost averaging.” By contributing a set percentage of your paycheck to your retirement account every pay period, you make automatic deposits, regardless of how the market is performing.

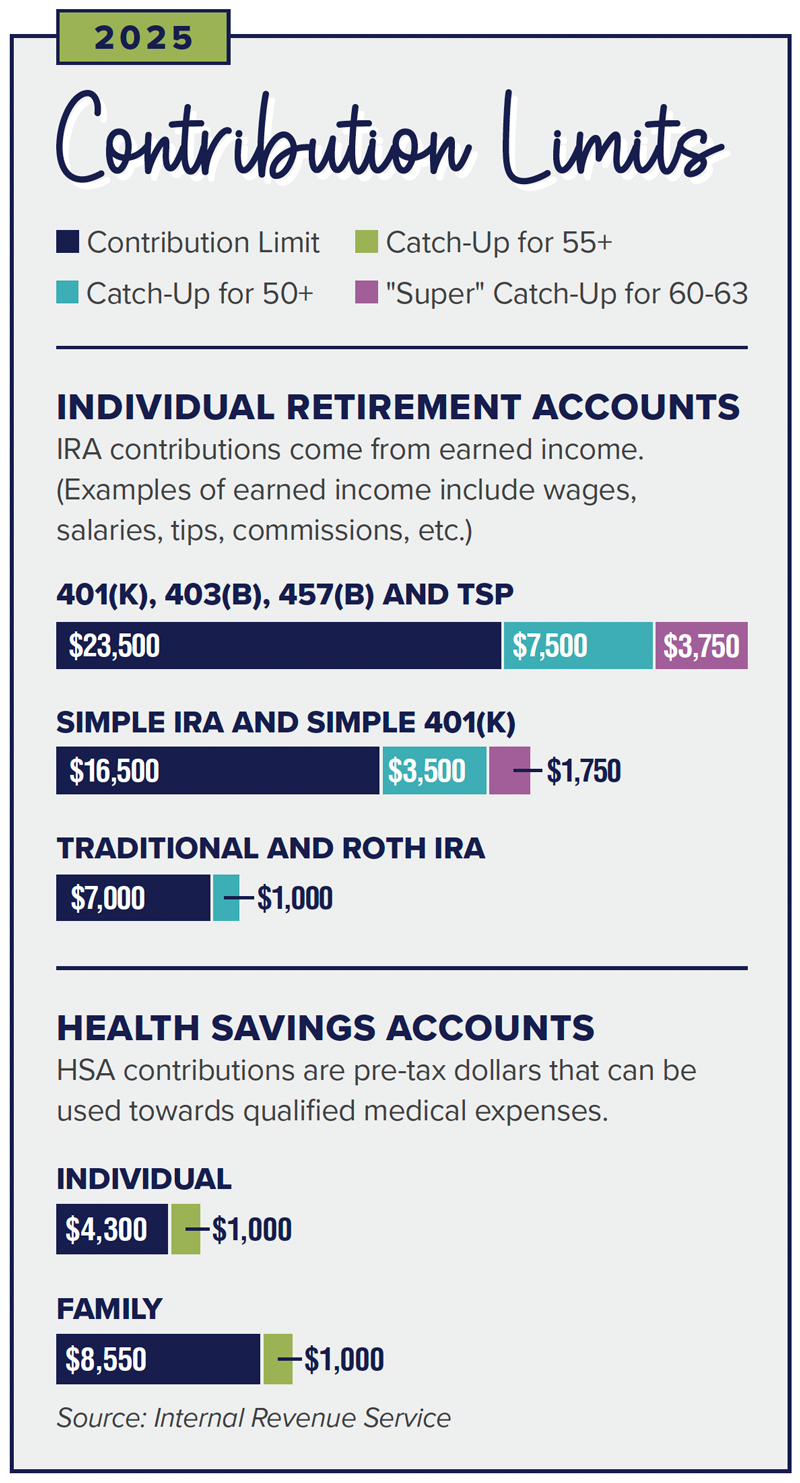

Those over 50 have had the opportunity to “catch up” when it comes to contributing to their retirement or health savings accounts. For example, as shown in the chart to the right, those who are 50 and over can contribute an extra $7,500 to their 401(k). For an HSA, those who are 55 and over can contribute an extra $1,000.

As it relates to 401(k), 403(b), 457(b) and TSP accounts, beginning in 2025, there is a new “super” catch-up opportunity in addition to the catch-up contribution for individuals who are 50 and older. Those who will be 60, 61, 62 or 63 in 2025 can now contribute up to $34,750, which is the standard limit of $23,500 plus two catch-up contributions that total $11,250.

An HSA is a health savings account and any money that is contributed can be used for out-of-pocket medical, dental and vision expenses. An HSA was designed to work like retirement accounts such as an IRA or defined contribution plans—with added tax benefits. It offers tax-deductible contributions, tax-free investment growth and tax-free withdrawals for qualified medical expenses currently and in your retirement years.

You must have a high-deductible health plan (HDHP) with a deductible of at least $1,650 for individual coverage and $3,300 for families and a maximum limit on out-of-pocket expenses. For 2025, the maximum annual out-of-pocket costs are $8,300 for individuals and $16,600 for families. Once this limit is reached, the health plan is required to pay 100% of the cost of benefits covered for the remainder of the plan year.

A Jemma Financial Advisor can help you open an IRA or HSA account, deposit money into the account, and select the appropriate investments to hold.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds