Cryptocurrencies are often featured in the headlines, prompting curious investors to wonder what it is, how it works and if they should invest in it.

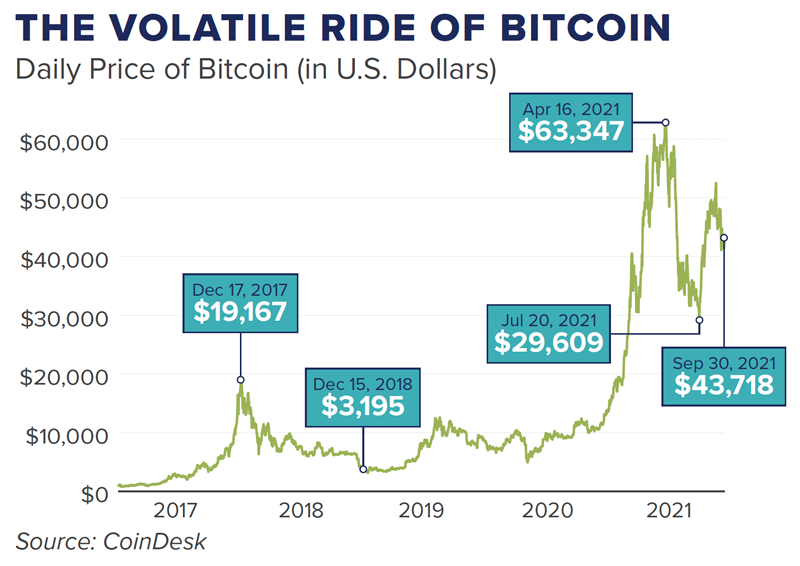

Bitcoin, the original cryptocurrency (crypto), was founded in 2009 by a programmer(s) under the pseudonym Satoshi Nakamoto. Crypto gained popularity in 2017 when Bitcoin’s price increased 1,318%.1 However, there have been corrections along the way. For example, Bitcoin’s price fell 80% in 2018.

Despite its volatility, Bitcoin has been the best-performing asset class over the past decade. From 2011 through 2020, Bitcoin rose 230% on an annualized basis—approximately 16 times higher than the S&P 500 Index, which increased nearly 14% over the same time frame.2

Over time, the crypto market has evolved and become relatively more mature, which has resulted in many large global companies supporting cryptocurrency as a form of payment.

Cryptocurrency is digital currency that can be used to buy goods and services like regular currency, such as the U.S. dollar. According to CoinMarketCap.com, more than 10,000 different cryptocurrencies are traded publicly. The difference between regular currencies and crypto is that crypto is not backed by real assets nor the full faith and credit of a government. Crypto uses an online ledger to secure online transactions. To put it simply, crypto is software.

Bitcoin is the most well-known cryptocurrency. According to the Bitcoin Foundation, Bitcoin is defined as a “peer-to-peer electronic cash system” that allows online payments to be sent directly from one party to another without going through a financial institution.3 Bitcoin uses cryptography which is the science of making and breaking codes. The blockchain, the underlying technology that supports cryptocurrency, is a decentralized network spread across many computers that manages and records transactions. Blockchain technology essentially eliminates the digital currency’s need for a central controlling authority.

The first step is to select either an exchange or a broker. A crypto exchange is a platform where buyers and sellers come together to trade crypto. An example is Coinbase, which is the largest crypto platform in the U.S. and is the first crypto exchange to go public in 2021. These exchanges typically have lower fees but tend to have complex interfaces.

Cryptocurrency brokers can simplify the process and offer easy-to-use interfaces that interact with exchanges for you. However, the fees may be higher and there may also be restrictions on moving your cryptocurrency off their platform.

Whichever route you choose, you need to create and verify your online account. Once verified, make sure you have funds in your account. This can be accomplished through linking your bank account, authorizing a wire transfer, or using a debit or credit card.

Once money is in your account, you place your cryptocurrency order by entering its ticker symbol and the dollar amount you would like to purchase. If purchased on your own through an exchange, ensure you have a secure storage place for your cryptocurrency, such as a crypto wallet.

There are two main types of “wallets” available: hot and cold wallets. Hot wallets are the most common and are meant for everyday crypto users. A hot wallet is created by downloading a mobile or desktop wallet from the exchange. The wallet connects to the internet which makes for smooth transactions. Cold wallets, typically more secure, are not connected to the internet. You only connect your cold wallet to the internet if you wish to make a transaction.

You can also indirectly invest in crypto through exchange traded funds (ETFs) or companies connected to cryptocurrency. Both alternatives may be less daunting than directly buying crypto.

Bitcoin is a highly speculative investment and can potentially be used as a hedge against inflation, although that assertion has yet to be proven. It also doesn’t fit neatly within traditional asset allocation models since it’s not a traditional commodity or currency. Some investors believe it is an asset class of its own due to its lack of correlation to other asset classes and provides further diversification to a portfolio, while others believe that it should not be included in any portfolio due to its lack of regulation. Bitcoin has been and remains controversial as it involves a significant potential risk of loss of capital.

Cryptocurrency is decentralized currency, meaning it is issued by private systems and not regulated by a government. Cryptocurrency exchanges are not backed by the Federal Deposit Insurance Corporation (FDIC) and your “wallet” could be at risk for theft. To reduce this risk, ensure you have a non-custodial wallet which allows you to hold the wallet’s keys and have control over your funds.

Over the past several years, cryptocurrencies have experienced significant price volatility, primarily due to the uncertainty about their store of value, means of payment and wide-spread adoption. As more institutional investors begin to invest in Bitcoin, it may strengthen legitimacy and pricing stability.

Looking to learn more about crypto? Talk with a Financial Advisor at Jemma.

1. “Cryptocurrency Investing for Dummies,” 2019. 2. YCharts. 3. Nakamoto, Satoshi, “Bitcoin: A Peer-to-Peer Electronic Cash System,” bitcoin.org.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds