There is a strong connection between mental health and finances. Facing financial challenges can lead to feelings of anxiousness and/or depression which, in turn, may impact overall health, reduce productivity at work or cause poor financial decision-making, such as prematurely withdrawing money from retirement accounts.

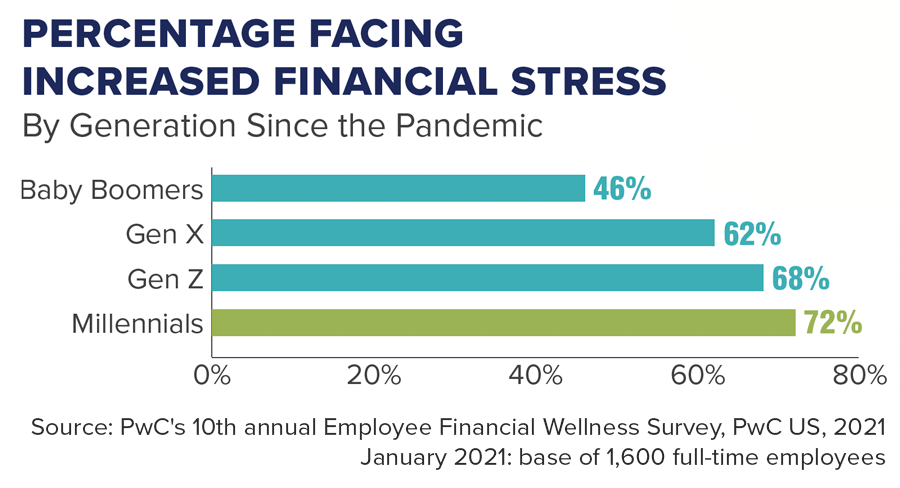

In a survey of 1,600 working U.S. adults, 63% indicated that they have experienced more financial stress since the start of the pandemic.1

To improve your financial situation, reduce your stress and enhance your well-being, you may want to consider implementing your own “financial wellness” program. Your plan of action should include the following:

Whether it’s an auto repair, medical emergency or even a layoff, an unexpected financial emergency can cause a lot of stress. According to a recent survey by Bankrate, only 25% of Americans have six months’ worth of expenses covered in a savings account for unplanned expenses and less than 20% say they could cover three to five months’ worth of bills and living costs with their emergency fund.2

Generally, three to six months’ worth of living expenses should be readily available. If building emergency savings needs to be in your future plan, develop a “pay yourself first” mentality. Determine the dollar amount you’d like to have after one year and divide by 52. Then, set up weekly automatic transfers of that amount from your checking account to your savings account.

Setting up a budget doesn’t have to be tedious and restrictive. Rather, look at it as a smart way to stay on track and to pay attention to your spending. Monthly costs can be fixed (mortgage payments, cable, gym memberships, etc.) or more flexible (dining out or shopping). The goal of establishing a budget and sticking to it is so you can have control over how you spend and save your money.

There are two types of debt: good and bad debt. Good, low-cost debt can be considered an investment, such as a mortgage, student loan, or business loan. There could also be tax advantages associated with these debts. On the other hand, high-cost bad debt comes into play when you are purchasing a discretionary item with a credit card. Credit card companies often charge high interest rates, so reducing outstanding credit card balances should be a top priority. Reducing credit card debt may also result in an improved credit score.

Review your various insurance policies and levels of coverage to see if they meet your current needs and family situation. In addition to health, auto and homeowner’s insurance, consider whether disability insurance should be a part of your financial safety net. Review your life insurance coverage, especially if you have young children and a family growing in number.

Almost one-third of all American students are going into debt to pay for college, and the average student loan debt reached a record high of $38,792 in 2020.3 To reduce your debt load more quickly, consider paying off more than the minimum amount each month.

Financial wellness programs can create many positive changes for investors. Your Jemma Financial Advisor can work closely with you to help get you on the right track so you can leave worry behind and work towards achieving your long-term goals.

1.”2021 PwC Employee Financial Wellness Survey,” pwc.com. 2. Bankrate’s July 2021 Emergency Savings Survey, bankrate.com. 3. “Student Loan Debt: 2021 Statistics and Outlook,” investopedia.com.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds