The pandemic has had a profound effect on many employees. Many Americans wanted to explore new career opportunities that offered more money, flexibility, and often a shorter commute, while many others simply chose an early retirement.

In fact, of the 5 million people who left the labor force during the pandemic, 2.5 million people retired. Of that 2.5 million, roughly 1.5 million were early retirements.1

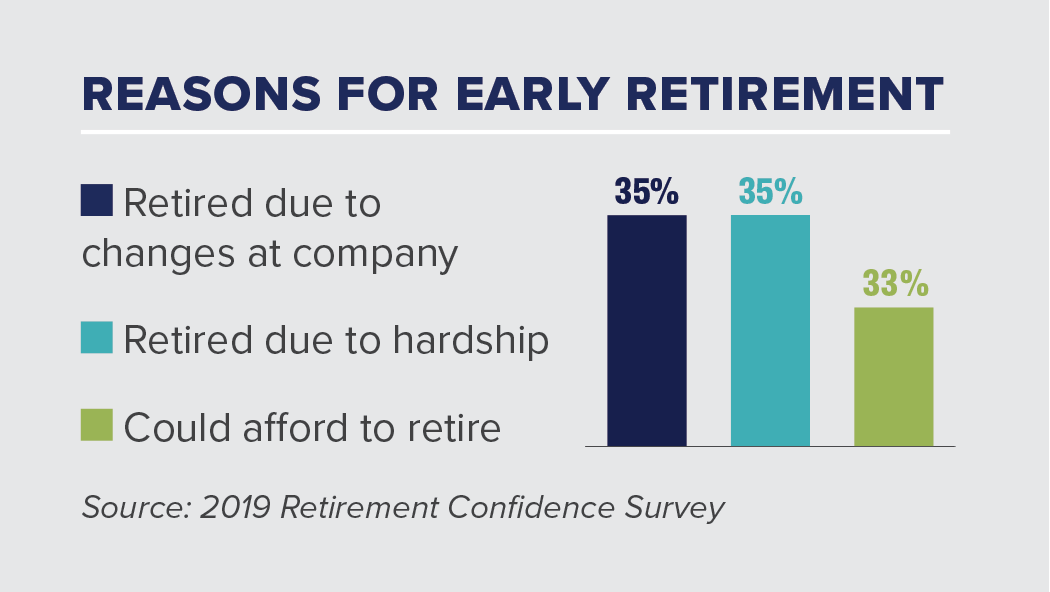

The reasons people retire early vary. According to a 2019 Retirement Confidence Survey, 43% of respondents said they retired earlier than they had planned. The reasons are included in the chart to the right.

If you or someone you know has retired early, or you are planning an early retirement, here are a few things to consider:

The retirement age when you can start receiving full Social Security benefits depends on when you were born. You can start taking Social Security at age 62 but your benefit amount will be smaller throughout the duration of your life. You can expect that your monthly benefit may be reduced by 30% if you begin receiving benefits at age 62 . If you wait until age 70 to receive your Social Security benefits, your amount will be much higher. (For more information, please visit www.ssa.gov/benefits/retirement/planner/agereduction.)

It’s important to understand your healthcare options and costs if you are younger than 65 — the age you become eligible for Medicare. If you do not have access to a spouse’s healthcare plan, then COBRA (Consolidated Omnibus Budget Reconciliation Act) could be the next best option. You are eligible for COBRA if you were enrolled in your employer’s health plan when you were working and the health plan is still available for active employees.

You may soon be transitioning from receiving a regular paycheck to partially relying on your savings to cover bills. Aggregating your retirement and/or investment accounts can help define the amount and where the money can come from. An updated budget will help provide insight on the amount of any anticipated shortfall.

Investing in a retirement account can offer tax-deferred savings and are excellent ways to build up your nest egg over time. However, there may be potential tax consequences if you withdraw the funds too early. Alternatively, you may want to plan on using other sources of income from non-retirement assets.

Planning on retiring sooner than expected? Working with your Jemma Financial Advisor can provide you with a roadmap on how to navigate this new journey.

1. “Goldman just figured out why the labor shortage will last for a long time: 60% of the missing workers retired, many for good,” businessinsider.com. 2. ssa.gov

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds