You’ve just landed your first job—congratulations! Now what’s next? Retirement! No, seriously, you should start planning now. Young, new employees often think about the idea of saving for retirement long before they actually do anything about it, often missing out on some big savings opportunities. Putting money away is the last thing anyone wants to discuss after they’ve just landed their first job and are about to receive their first real paycheck, but it should be a top priority.

To understand why you should save for retirement in your 20s, you need to have a clear understanding of compound interest—a powerful tool only if you start early. Compound interest rewards you for not only the actual dollars you invest (your principal), but also on what those dollars earn (your interest). This financial lingo can sound confusing, but using numbers to illustrate the concept makes it much easier to understand:

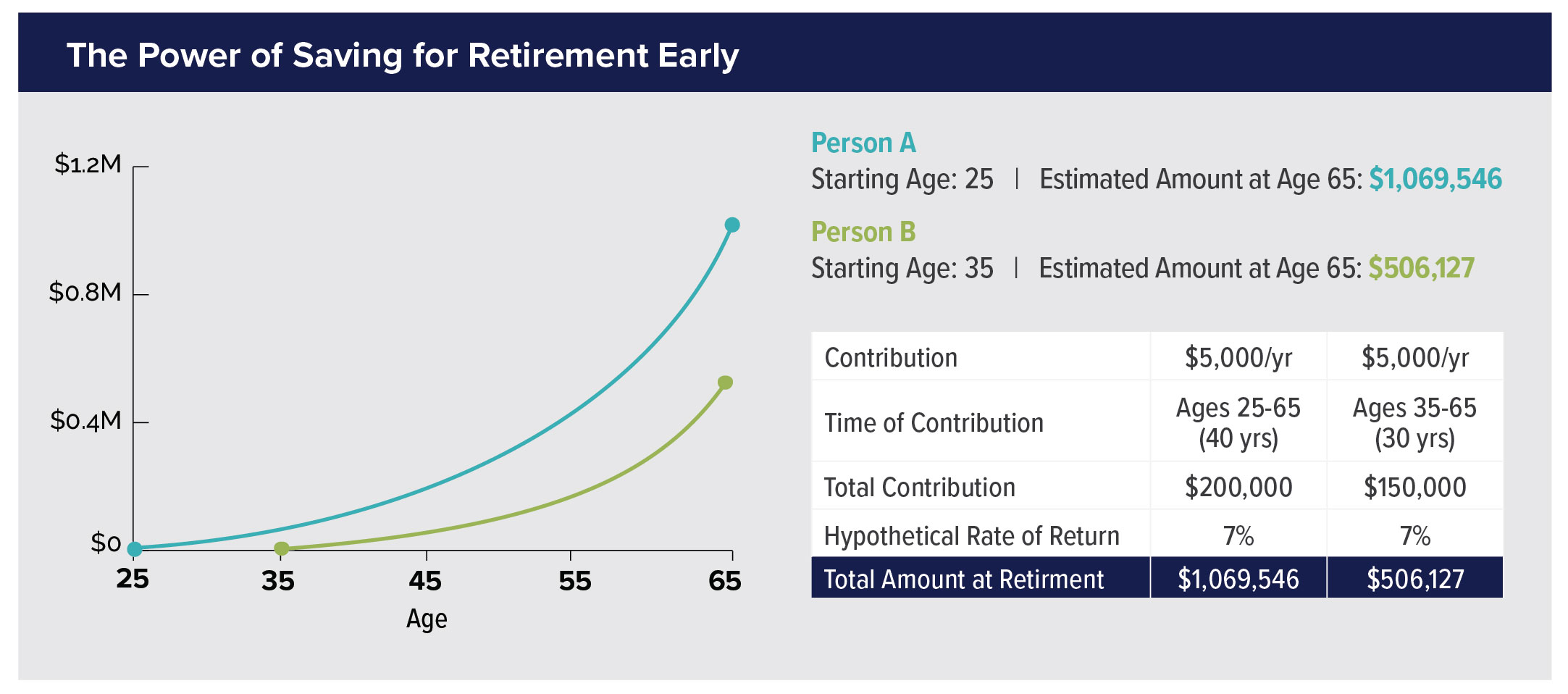

Say, for example, you put $5,000 into your retirement account every year starting at age 25, up until you retire at 65—a total contribution of $200,000 over 40 years. Thanks to the power of compound interest, history shows you could end up with almost $1.1 million in savings. Sounds unbelievable, right? Well actually, it’s very possible if you just start early.

For argument’s sake, let’s say that you wait a few years and instead start saving at age 35, again continuing until you retire at 65. Over these 30 years, your contribution totals $150,000. However, because you missed those first 10 years in your 20s, rather than surpassing the $1 million mark, the math shows you’d have ended up with about half of that—all because your investment had less time to allow interest to compound.

Because Person B waited 10 years to start saving for retirement, they ended up with over $550,000 less at age 65.

This is a hypothetical example that assumes a 7% annual return and not intended to reflect the actual performance of any specific investment. Earnings are pretax, and may be subject to income tax when distributed. Source: NerdWallet

Usually people don’t start saving for retirement in their 20s because retirement seems so far off and there are many other priorities such as rent, car or student loan debt payments. Luckily, when you set up a 401(k) plan, the amount you decide to contribute is automatically deducted before it even reaches your bank account, so you never have to worry about budgeting and saving it yourself. Be sure to set it up on your first day of work so that you immediately start saving for retirement without even thinking about it. Then, when the paycheck comes every cycle, you never have to make a choice about how to save or spend your money.

But how much should you contribute? If your employer offers a 401(k), ask if they also have a company match policy which will match your contributions up to a certain percent. If your employer offers a match, you should take full advantage of as much as they offer, as it’s basically doubling the amount that you’ll be saving yourself.

Saving for retirement in your 20s might not seem like the most glamorous thing to do with your money. But, by saving even just a small amount early on, your money will have an opportunity to compound, or increase exponentially. In turn, investing early may make you more comfortable in the long run and allow you the financial freedom to enjoy the lifestyle you want 40 years down the road.

If you’re not sure where to begin, help is available at Jemma Financial. Contact us today to start a conversation and to begin saving for your financial future.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds