In 2022, nearly 60% of U.S. households owned stocks, which is the highest rate recorded.1 This interest in the stock market is a positive trend as investors may be recognizing that stocks have historically outperformed other asset classes, albeit with periods of volatility along the way.

However, there can be a vast difference in investing in individual companies compared to mutual funds and exchange-traded funds (ETFs). Selecting individual stocks often requires time to research and an understanding of the business fundamentals such as debt, cash flows, revenues, and valuation to determine a potential solid investment. In addition, while investing in individual companies can lead to significant outperformance relative to the market, this investment approach can substantially increase portfolio risk and volatility.

However, there can be a vast difference in investing in individual companies compared to mutual funds and exchange-traded funds (ETFs). Selecting individual stocks often requires time to research and an understanding of the business fundamentals such as debt, cash flows, revenues, and valuation to determine a potential solid investment. In addition, while investing in individual companies can lead to significant outperformance relative to the market, this investment approach can substantially increase portfolio risk and volatility.

If you’ve heard the phrase “don’t put all your eggs in one basket,” here’s why it matters, especially now:

The market is highly concentrated. As of 1/31/24, the top 10 largest stocks by market capitalization make up 30% of the S&P 500 Index.

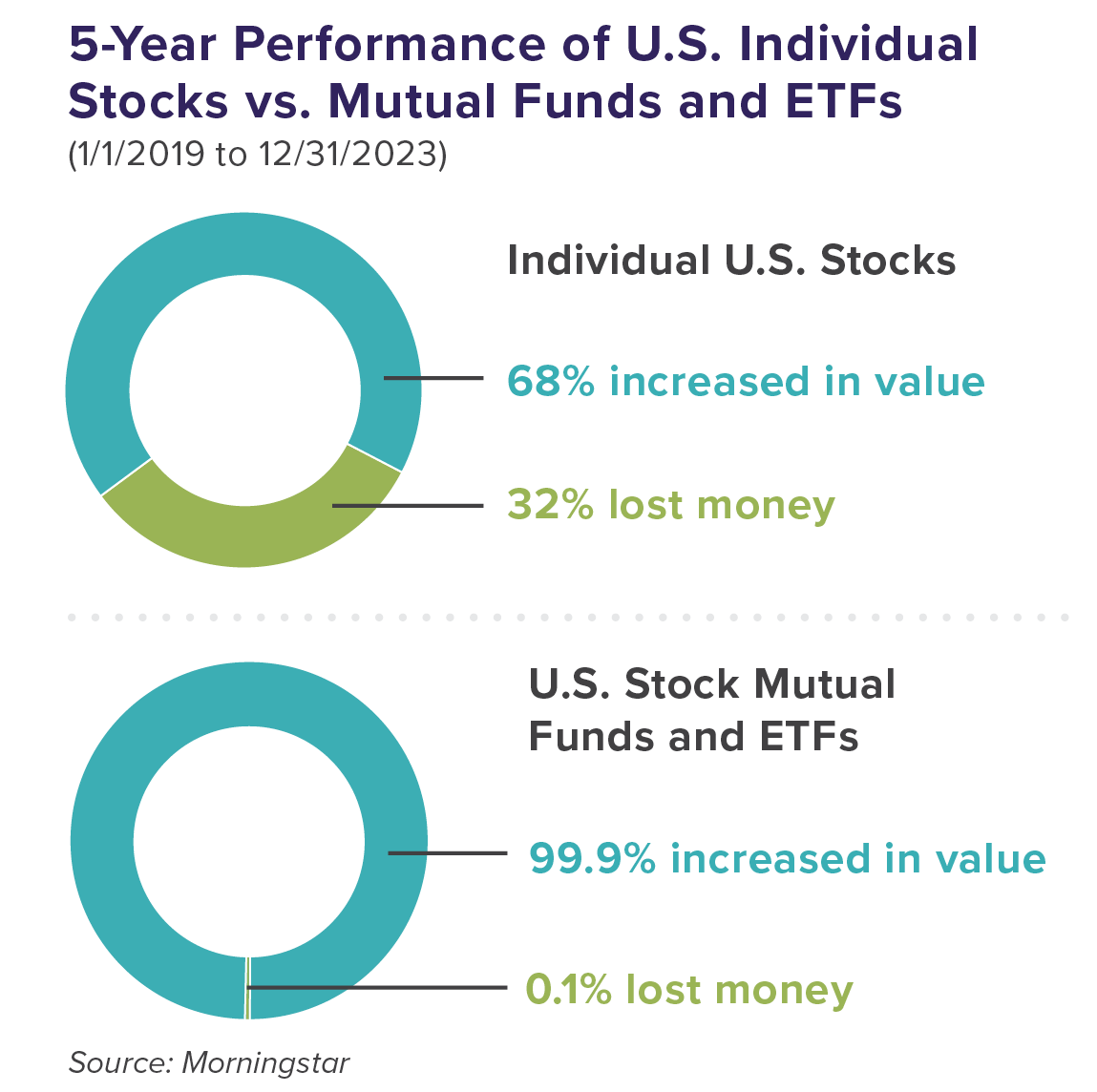

Your chances of losing money in individual stocks are higher compared to holding mutual funds and ETFs. Looking at the 5-year performance of all the publicly listed U.S. stocks, nearly one-third lost money from the beginning of 2019 through the end of 2023.

It was not just small, unheard-of businesses that fell victim to market forces. Large and well-known companies also suffered serious declines.

By comparison, less than 1% of mutual funds and ETFs lost money, which speaks to the power of diversification in investing in a broader portfolio that seeks to achieve the greater likelihood of positive returns and lower risk.

Investing requires a long-term perspective. Jemma Financial can help you build a diversified portfolio based on your situation, taking into account your age, financial goals and risk tolerance. Click here to get started.

1 Board of Governors of the Federal Reserve System, 10/23.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds