When you’re in your 20s, and someone reminds you to start saving for retirement, mostly what you hear is, “blah blah blah.” You toss that bit of advice into your Words of Wisdom box, along with “eat your vegetables” and “go to the dentist twice a year,” and tell yourself you’ll worry about that later. You have lots of time, you think.

The trouble is, when it comes to saving for your future, you really can’t afford to wait. By the time you get around to signing up for your 401(k) or opening an IRA, you may have missed out on some of the most important wealth-building years of your life.

Use Time to Your Advantage

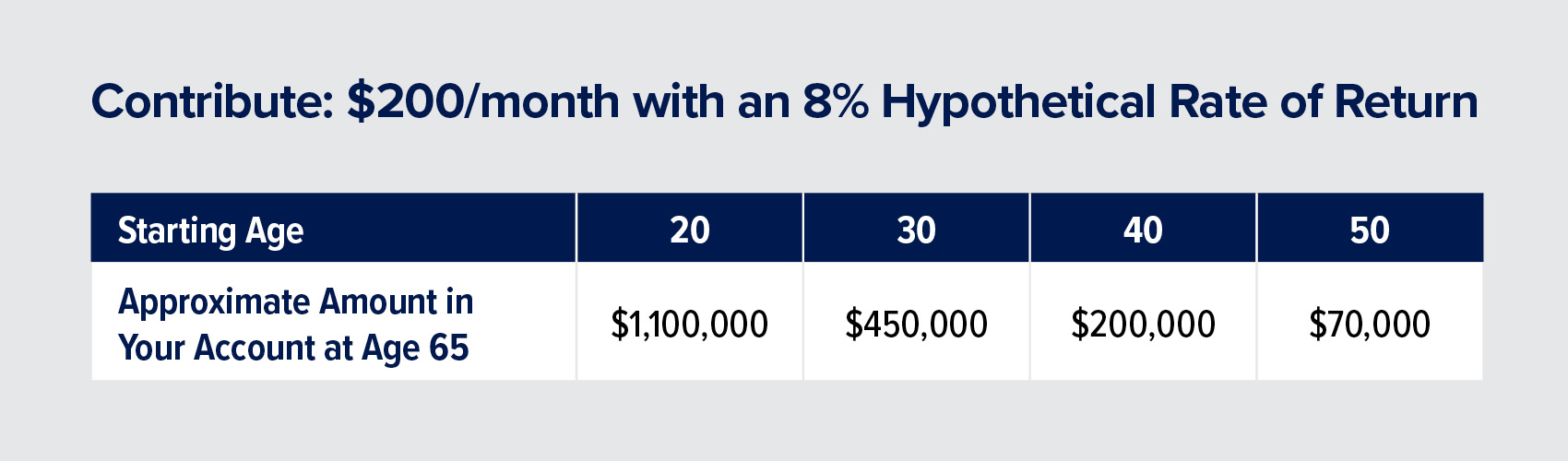

Compounding, which allows the interest or dividends to build upon themselves over time, is the main reason it pays to start saving early. When you’re 20-something, and you invest a small amount each month until you reach retirement age, you may wind up with far more money than someone who starts saving in their 40s or 50s. Consider this example:

Let’s assume you sock away $200 per month in your 401(k) or IRA—a fairly doable amount for most people, especially if some of that contribution involves a match from your employer. As you can see, the earlier you start building your nest egg, the bigger it gets. The exponential growth over time takes your breath away. According to this calculator, a 25-year-old feasibly could become a millionaire by the time he or she reaches age 70. On the other hand, if you wait until you’re 55 years old to start saving for retirement, you may find yourself coming up short during your golden years.

This is a hypothetical example and not intended to reflect the actual performance of any specific investment. Earnings are pretax, and may be subject to income tax when distributed.

Source: 360 Degrees of Financial Literacy

Five Easy Tips for Setting Up Your Future

Remember, “Start saving now” is not just a frivolous piece of advice to be set aside and dealt with later. They are words to live by. If you’re not sure where to begin, help is available here at Jemma Financial.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds