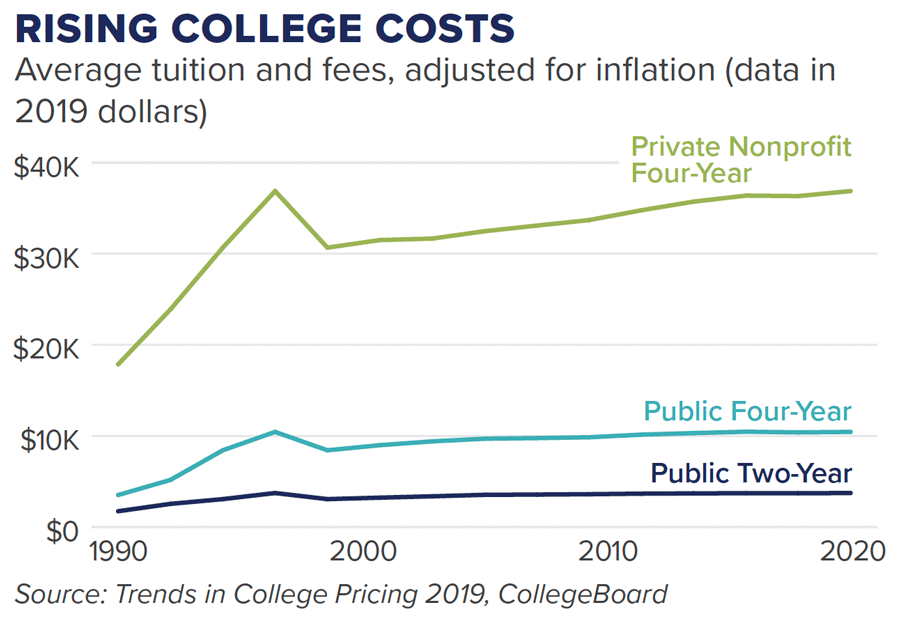

It is never too early to start saving for college. Everyone wants their child to succeed and have the best education possible. However, college is expensive, and the costs continue to rise. In fact, college costs have exceeded the inflation rate for the past decade. Assuming an annual increase in tuition and fees of 6%, it could cost over $260,000 to send a child who is now a toddler in 2021 to an in-state, public college for four years. Private college is even more expensive, costing nearly $600,000.1

To help pay for a college education for your child or grandchild, it is important to have a long-term plan and get started as soon as possible. Much like saving early for retirement, setting aside money early in a child’s life will enable the compounding of money to take effect. For example, an initial investment of $5,000 compounded annually at 10% will yield $500 after one year. In year two, the growth will equal $550 as the gain in year one is compounded by 10% as well.

How do you get started? Setting up automatic monthly or quarterly deductions into a tax-advantaged investment account is one easy and effective strategy. A few of these options include:

529 accounts encourage saving for future higher education costs while providing tax advantages. Typically, these accounts are sponsored by state governments and many states will allow you to deduct your contributions on your state income tax return. The money can be withdrawn for qualified educational expenses without paying tax on any investment gains.

Similar to a 529 plan, Coverdell ESAs allow money to grow tax-deferred and withdrawals are tax-free at the federal level (and in many cases the state level) when used for qualified educational expenses and the account holder is less than 30 years old. However, to be able to contribute the full $2,000 a year to a Coverdell, your adjusted gross income cannot exceed $110,000 or $220,000 for a married couple filing a joint return.

Most people would associate a Roth IRA with retirement, but this account can be an effective vehicle for individuals to invest after-tax dollars while not subjecting appreciation to taxes as long as the appropriate distributions are made. There are pros and cons to this account. A limitation is that other relatives cannot contribute to a Roth IRA like they can in a 529 plan. But with a Roth IRA, if a child decides to not attend college, the funds can be used for retirement.

The earlier parents and/or grandparents start saving, the less a college student may need to borrow. Nearly one out of three American students go into debt to get through college, with the average student loan debt reaching a record high of $38,792 in 2020.2

As always, each education designated account has its own particular program rules and tax implications. A knowledgeable Jemma Financial Advisor can provide you with answers and a roadmap on how to navigate college expenses.

Sources: 1. Investopedia/ College Savings Plans Network, “College Cost Calculator”, Jan 2022. Includes tuition, on campus living and additional fees. 2. Investopedia, “Student Loan Debt: 2021 Statistics and Outlook”, April 2022.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds