When it comes to long-term investing, it’s often the fear of the unknown that causes individuals to make emotionally based decisions that may have detrimental effects on their portfolio.

Below are three strategies that may help when markets get volatile:

Times of increased market volatility come as an important reminder to maintain a diversified portfolio. This may decrease risk while simultaneously increasing the potential for investment returns. Diversification may reduce the severity of market fluctuations since different asset classes have varying degrees of correlation with each other and, therefore, experience different returns. Holding a variety of asset classes may reduce the likelihood that any one asset class may have a disproportionate adverse effect on an investor’s portfolio.

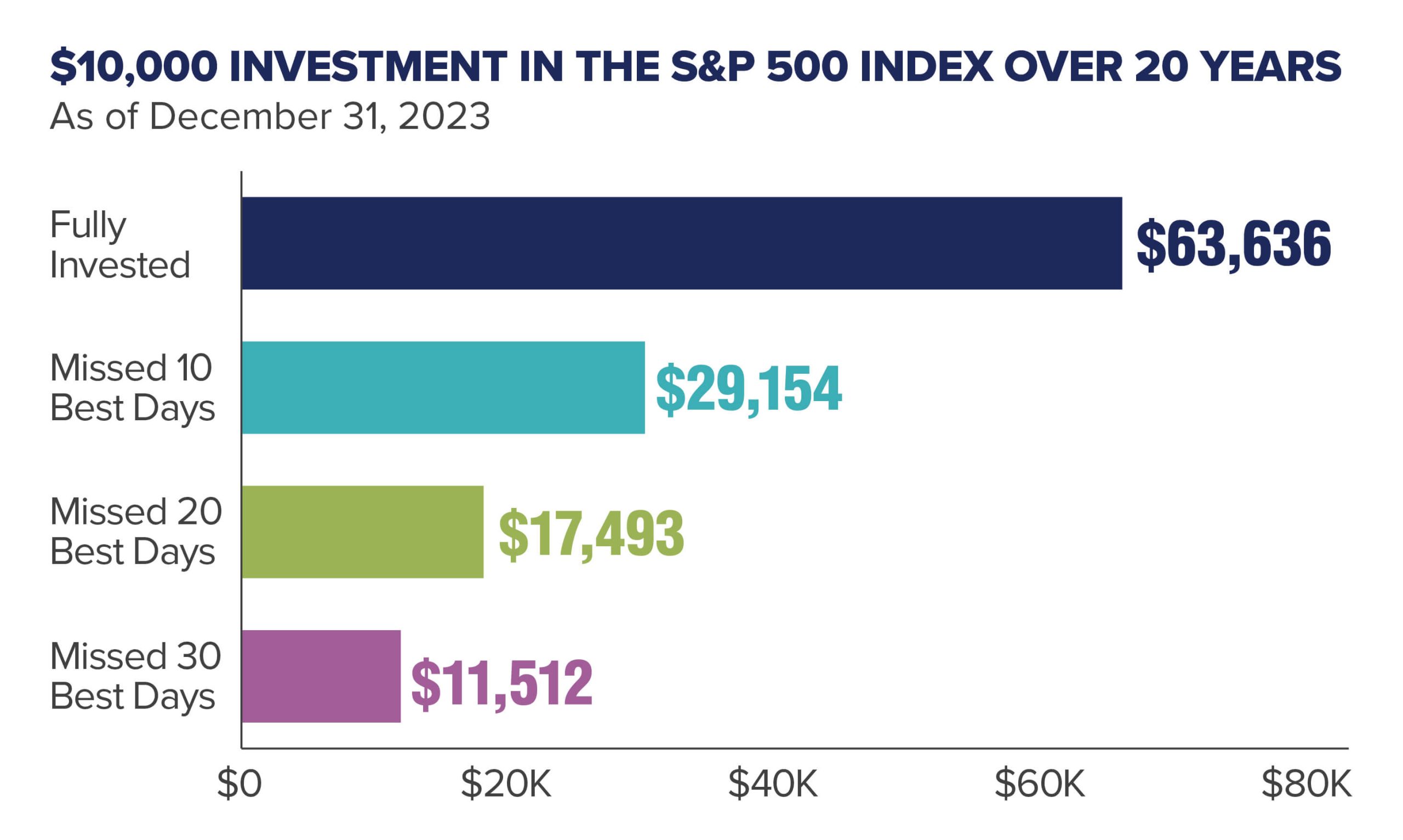

Often the key to investment success is to stay invested as the market inevitably rebounds. For example, over the past 20 years, $10,000 invested in the S&P 500 Index has grown to over $60,000. However, if you missed the 10 best days of market performance over that time, your investment would be less than half that amount. And if you missed the 20 best days, your investment return would have been 72% lower.

Portfolio rebalancing can be a powerful tool for investors. It is a great way for investors to stay true to a particular risk profile and with regular frequency alter their asset allocation, as appropriate, to enable them to stay on track to meet their long-term goals. It is important to review your financial plan and risk tolerance with your Jemma Financial Advisor who will help you determine your target asset allocation, especially if you recently experienced a significant life event such as marriage, a divorce or birth of a child.

Market volatility is a normal occurrence when investing in the stock market. Importantly, having a disciplined approach and staying the course are often the best tactics for long-term success.

Need assistance? Call 855.662.2121 or email info@jemmafinancial.com

Important Notice

You are now leaving the Jemma Financial Services website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) website.

Schwab is a registered broker-dealer, and is not affiliated with Jemma Financial Services or any advisor(s) whose name(s) appear(s) on this website. Jemma Financial Services is/are independently owned and operated. [Schwab neither endorses nor recommends {Name(s) of Investment Management Firm(s)}, unless you have been referred to us through the Schwab Advisor Network®. (This bracketed language is for use by Schwab Advisor Network members only.)] Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with “Name(s) of Firm(s)” under which Schwab provides Jemma Financial Services with services related to your account. Schwab does not review the Jemma Financial Services website(s), and makes no representation regarding information contained in the Jemma Financial Services website, which should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

IMPORTANT NOTICE

You are now leaving the Jemma Investment Advisors, LLC Website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website. Schwab is a registered broker-dealer, and is not affiliated with Jemma Investment Advisors, LLC, or any advisor(s) whose name(s) appears on this Website. Jemma Investment Advisors, LLC is independently owned and operated. Schwab neither endorses nor recommends Jemma Investment Advisors, LLC. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Jemma Investment Advisors, LLC under which Schwab provides Jemma Investment Advisors, LLC with services related to your account. Schwab does not review the Jemma Investment Advisors, LLC Website, and makes no representation regarding the content of the Website. The information contained in the Jemma Investment Advisors, LLC Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

This will close in 0 seconds